Real Estate Reno Nv - Questions

How Real Estate Reno Nv can Save You Time, Stress, and Money.

Table of ContentsFascination About Real Estate Reno NvAll about Real Estate Reno NvUnknown Facts About Real Estate Reno NvSome Known Factual Statements About Real Estate Reno Nv

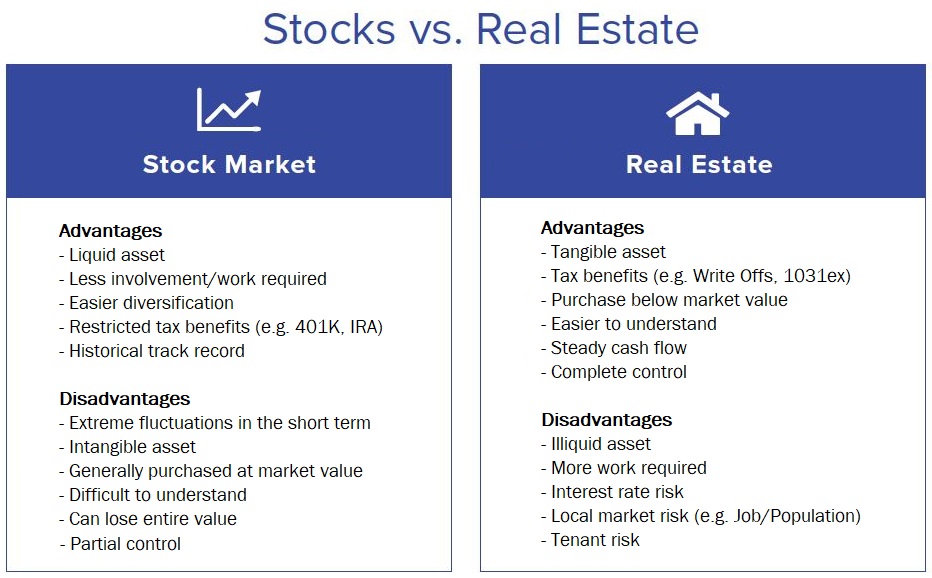

That might show up expensive in a world where ETFs and mutual funds may bill as low as no percent for building a diversified portfolio of stocks or bonds. While systems might vet their investments, you'll need to do the exact same, which indicates you'll need the skills to assess the chance.Like all financial investments, actual estate has its pros and cons. Long-term gratitude while you live in the residential property Potential hedge against inflation Leveraged returns on your investment Passive earnings from leas or with REITs Tax obligation benefits, consisting of rate of interest reductions, tax-free funding gains and depreciation write-offs Taken care of lasting funding readily available Admiration is not assured, especially in economically depressed areas Residential or commercial property costs may fall with higher rate of interest prices A leveraged investment means your down payment is at threat Might need considerable time and money to manage your very own residential or commercial properties Owe a set home loan settlement every month, even if your renter doesn't pay you Reduced liquidity for genuine building, and high payments While genuine estate does provide many benefits, specifically tax obligation benefits, it doesn't come without substantial downsides, in specific, high commissions to leave the market.

Or would certainly you choose to examine deals or financial investments such as REITs or those on an on-line platform? Understanding and abilities While many financiers can learn on the job, do you have special skills that make you better-suited to one kind of financial investment than another? The tax benefits on actual estate vary extensively, depending on how you invest, yet investing in genuine estate can use some substantial tax obligation benefits.

About Real Estate Reno Nv

REITs use an attractive tax profile you won't incur any type of funding acquires taxes until you sell shares, and you can hold shares actually for decades to avoid the tax obligation male. As a matter of fact, you can pass the shares on your heirs and they won't owe any tax obligations on your gains.

Property can be an attractive investment, but capitalists intend to make certain to match their kind of financial investment with their readiness and capacity to handle it, consisting of time dedications. If you're aiming to generate revenue throughout retired life, realty investing can be one method to do that.

There are a number of benefits to investing in realty. Consistent revenue flow, solid yields, tax benefits, diversity with well-chosen assets, and the ability to utilize wealth via property are all benefits that financiers may delight in. Below, we look into the numerous benefits of purchasing actual estate in India.

Some Known Details About Real Estate Reno Nv

Property often tends to value in value visit this page in time, so if you make a wise financial investment, you can profit when it comes time to market. In time, rents additionally tend to enhance, which could raise cash money circulation. Rents boost when economic situations increase since there is even more demand for genuine estate, which raises resources values.

One of one of the most attractive resources of easy revenue is rental revenue. Among the easiest techniques to maintain a stable earnings after retirement is to do this. If you are still working, you might increase your rental revenue by investing it following your economic goals. There are numerous tax obligation advantages to property investing.

5 lakh on the concept of a mortgage. In a similar capillary, section 24 allows a reduction in the required interest payment of up to Rs 2 lakhs. It will considerably reduce gross income while decreasing the price of realty investing. Tax deductions are attended to a selection of expenses, such as business expenses, capital from other assets, and home loan rate of interest.

Realty's link to the various other primary possession groups is breakable, at times also unfavorable. Realty might for that reason decrease volatility and boost return on danger when it is included in a portfolio of numerous possessions. Contrasted to various other possessions like the supply market, gold, cryptocurrencies, and banks, buying property can be dramatically much safer.

Real Estate Reno Nv Can Be Fun For Everyone

The securities market is continually internet changing. The property sector has actually grown over the past numerous years as an outcome of the application of RERA, reduced home lending rate of interest prices, and various other elements. Real Estate Reno NV. The passion prices on financial institution savings accounts, on the other hand, are low, you can check here particularly when compared to the rising inflation